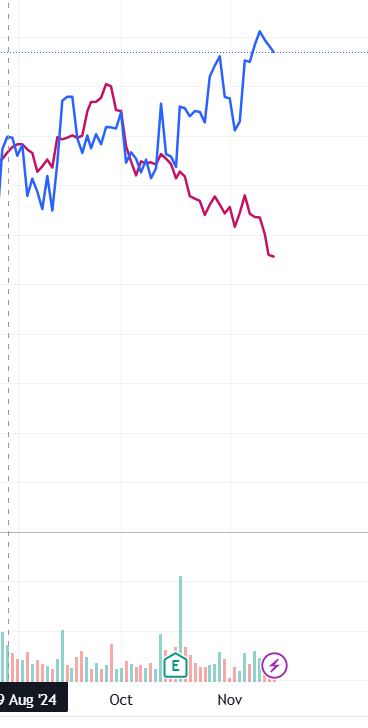

This is the time to review WIPRO who has shown a decent run-up despite the challenging quarterly results in last 2-3 quarters. In this year 2024, it has Rs 450 to Rs 575, providing a great return of approx 27%. Despite the NIFTY index turning negative and challenging demand environment as acknowledged by management of major IT companies, this stock has been doing pretty decent. Below snapshot captures the same essence. WIPRO is shown by blue line and NIFTY represents Red line. Now what ? Read on….

If we look at the below snapshot, we can see a good run up in leg 3 and then in leg 5 of the Elliott Wave (EWT) and now we are on the verge of exhausting the normally expected run in Wave 5, which suggests us to book profit right away. Even a better way would be to set up a trailing stop loss at 550. However, if you are sitting on decent profits, it is time to take out profits and wait for 20% cut to re-enter in this stock

- Contributed by D.Aggarwal (SEBI RA) Date – 16/Nov / 2024