Here is the midcap chemical stock (ACI, Archean Chemicals) which fell by more than 26% since Feb’24. This is a very strong chemical sector play as mid-tier chemical company.

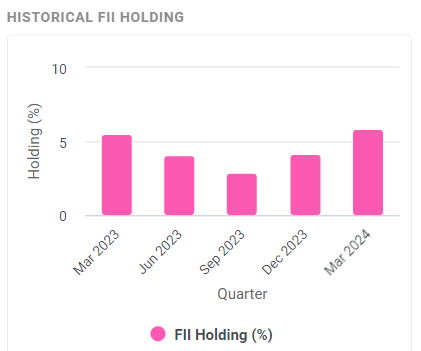

Now, after it fell from Rs 833 by more than 35% in anticipation of a weak quarter in March’24, it has made a base at Rs. 580. Since then, it has recovered to the current market price of Rs 621. The stock is going to face good resistance until it crosses Rs.650. But as soon as it crosses it, there is a high chance of it reaching the first target of Rs 710 in a few weeks, and then up to 830 which can be pursued using trailing stop loss. Refer below chart. Also, FIIs have increased their holdings significantly.

Stock is having high margins of around 24% which is the best in the industry, and still maintaining low trailing PE of 24 and forward PE of <15. Compared to its peers, it is much cheaper and has got great potential.

Stop loss must be large at Rs 500 (as it could take a break from upside motion. In that case you must average it out by buying more quantity.) This is high conviction trade

Delivery volume has suddenly increased above monthly and weekly averages, hence reflecting investors’ confidence.

Trend of FII holdings. It has increased in the last 2 quarters after falling earlier. FII holdings at end of March 2024 are even higher than they were at the end of March 2023.

You may consider reaching out to us for various services that we are offering.

You may also see our performance record in past by going to this link in menu. You may also contact us on whatsapp (check contacts in Menu)

#Mid cap stocks, #Stock market recommendations, #Investing in mid cap stocks, #Mid cap stock picks

#Top mid cap stocks to buy

#Growth potential of mid cap stocks

#Mid cap stock analysis

#Benefits of investing in mid cap companies