If you have been in the stock markets closely observing it, NIFTY has just told you who is going to win. Only question is, did you have the right ears to catch that frequency?

Markets have got a very complex relationship with election results for the obvious reasons that they want a government which is business oriented and intelligent enough to strike a perfect balance between a plethora of complex options to govern the economy. And when this election is about a country as big and complex as India, which can be termed as most heterogeneous country because of multiple factors, one thing which any business wants is continuity of a government which has been responsive.

Mincing no more words, let’s put some facts straight that Indian markets have progressed very well with economy in robust shape due to policy approach of Modi government in last 10 years. And businesses have grown, that’s why markets want the same government to continue. We have seen the exuberance when we got state election results in Q3 last year which put markets in a “tizzy” exuberance. This had set the narrative that BJP government is the only outcome of Lok sabha elections in 2024.

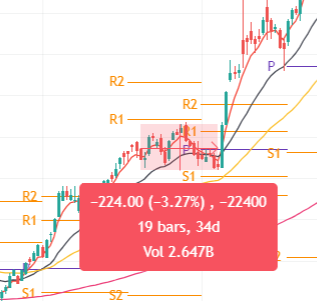

This had setup the stage of fierce bull market again which had already risen by around 18% over 6-7 months from April 2023 to October 2023. See this chart.

As soon as BJP won state elections comprehensively, Markets started another upleg and within 2 and half months, we saw another 17% returns on the top of earlier returns. See below snapshot

Now Markets had already moved by around 32% from March 2023 lows, and now it was the time for consolidation in January and February. Markets consolidated with a positive bias and remained in a slow uptrend with a limited downside. Each sudden fall was bought even more vigrously. Now what all of this commentary has to do with the prediction of election outcome? Let me explain..

Now going into the month of April, VIX was hovering around 13 which was much lower as compared to 16-17 range of VIX one month preceding to 2019 elections. To add to the mystery, after 1st phase of elections, VIX surprisingly tumbled by around 20% leaving the analysts scratching thier head for the reasoning. But then VIX constantly started rising and in a matter foffew days, jumped by 100%. This indicated that market was nervous. But considering the base effect of lower levels of VIX (below 10), rising up to a level of just under 20, is actually not much. This still indicates only one thing…. continuity of the current government for which market participants are largely confident. But still VIX rose to 20 as until the even has passed successfully, it is still a risk. So here is what markets are actually telling you:

First, the VIX to start this election season was historically low while it is expected to be high due to heightened volatility due to a big even like elections. So, to start with VIX was low and it drowned further. But then came the voting percentages or you can call it some reason for the markets to feel some jitters, leading to spike in VIX. If markets run too smoothly on upside far too long and that too near the election event, that itself is unusual and “jittery” for the market participants. Then they need some reasons to square off their positions to book some gains. Exactly that happened in the last few weeks of May. While Dow and other US/EU markets were making new highs, Indian market remained subdued.

But on 16th May, election commission just uploaded latest figures of the voting percentages till now, and it was evident that gap between 2019 and 2024 voting percentage is not much. That gave a releif to the market. Does that mean a positive outcome for BJP?

Only based on voting percentage, we can’t figure it out. We need to look at what happened to the markets just before elections in previous years. Below is the chart for 2019, pre-election phase, markets were down around 5% as markets were nervious if Modi will again come back? They had the collapse of 2004 still fresh in their mind.

Here is the snapshot for 2014. Here markets were anticipating that BJP would win, only quesiton was about the margins. And markets were not willing to fall. Similarly, this year also, despite suddent profit booking and nervousness, which is obvious, markets have been bought even with more vigour.

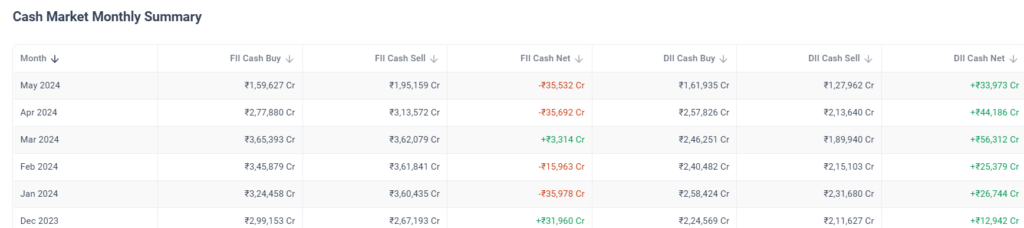

Now add to that the fact that FIIs are not participating in the current rally and at some point of time, they are going to join the party. Right now, DIIs have concluded that BJP is going to win and then after NIFTY breaks above 22800, FIIs will support the market in a big way. To put it in perspective, if you look at below snapshot, FIIs have been big sellers in 2024, firstly due to higher interest rates expectation in US (Higher – for – longer approach) and due to big even like Indian elections. Some money has also got diverted due to China has come back strongly. But, FIIs must be disappointed a lot as they would want to come to Indian market, but valuations have only increased, against their liking. Thanks to domestic investors.

So, the only option worth considering in the market is buy. If not 100%, I am putting my 70-80% right now in the market!

– Signed by

D. Aggarwal (SEBI RA # INH000013299)

Pingback: What next for NIFTY on 3rd and 4th June? - Uncover Markets