In the last article written on 15th November (click here to read), we provided two scenarios where we suggested that Gold was looking for an immediate bounce back by 1-4% from the levels of 2544 that it achieved on 14th November. So, looking at the current price of Gold, we are hovering around 2660 which is around 4.5 % above the lows of ~ 2550. We further suggested that the downtrend till point 2550 was part of initial wave and after a bounce back, we expected it to fall again to 2450. However, much has changed geo-politically in just a week.

Thanks to the uncertainty in current geo political landscape, it looks like there is some confusion with the mindset of Gold traders. In recent months, the ongoing geopolitical tensions between Russia, Ukraine, and NATO have significantly influenced the global gold market. The support extended by the USA and NATO to Ukraine has exacerbated the situation, leading to heightened concerns of potential nuclear conflicts. This has, in turn, triggered a rapid increase in gold prices, as investors flock to this traditional safe-haven asset in times of uncertainty.

As of now, gold prices have again soared to 2670 from the recent lows of $2,550. This surge signals the market’s anticipation of prolonged volatility and a potential new bull trend for gold. Despite the current rally, it is important to note that gold has completed a fresh impulse wave, suggesting that some profit-booking might be imminent. uncovermarkets.in predict a possible short-term correction of around 1-3% as traders take profits off the table.

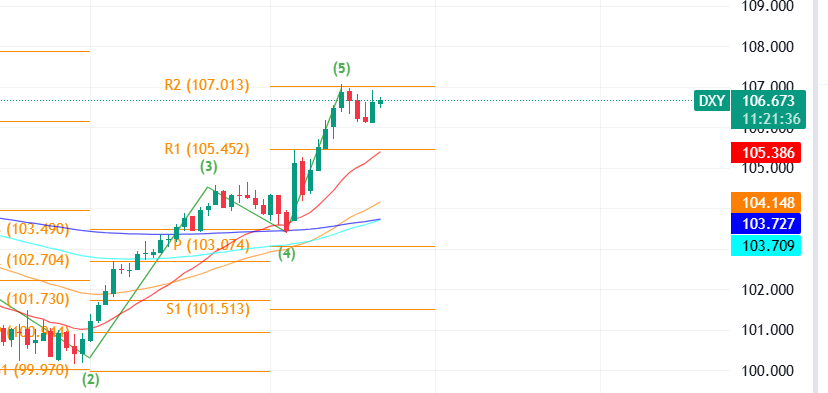

For those considering entering the gold market, the question arises: When is the right time to take a position? It’s essential not to rush into trades just yet. Market dynamics indicate that a minor price correction is likely in the very short term, possibly within the next 2-7 days. However, if the gold price breaches the critical resistance level of $2,680, it would signal a strong buy opportunity, suggesting that the uptrend is poised to continue. Conversely, if the price falls below the $2,540 support level, it would be prudent to target the $2,450 mark, indicating a potential downward trend. As for now, our stance is cautiously bullish as you can observe that dollar index has cooled down after recent rally.

Chart for Gold prices

In conclusion, while gold prices are currently in a consolidation phase, investors should remain vigilant and closely monitor evolving geopolitical conditions. The key range of $2,680 and $2,540 will serve as crucial range before we decide future market direction. Staying informed and patient will be vital for making strategic investment decisions in the coming weeks. If prices breach this range, then only we will initiate Long and short calls respectively.

Dollar Index chart- showing all likely hood of weakness ahead due to mean reversion factors on Bollinger Bands, and pivot point indicators.